Knowledge Strategy, Metrics and Measurement

Managing the Unmeasurable

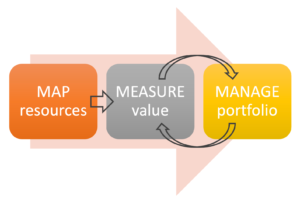

“If you can’t measure it, you can’t manage it.” We’ve all heard that. Metrics makes things real; they are the language of management, just as they are the language of science and technology. As the diagram shows, there’s a rinse-and-repeat relationship between measurement and management.

But knowledge, especially as it applies to the enterprise, cannot be measured in any conventional sense. And this stems from an even greater problem — that there is no wide consensus on what constitutes “knowledge” as it applies to organizations.

So we can neither measure knowledge reliably, nor define it convincingly — but, undaunted, we propose to manage it? The term knowledge management seems to codify a contradiction that limits its credibility as a management tool. It’s difficult to build trust and support among knowledge clients and (especially) sponsors upon such an ethereal value proposition.

Why do we measure things?

Organizations and their managements run on numbers. The numbers that power enterprise are both internal — things like key performance indicators (KPIs) — and external — metrics that are reported to external stakeholders, for example financial statements filed with regulatory authorities.

Numbers enable us to be data-driven, evidence-based, rigorous, accountable, fair-minded, even scientific in managing — all goals toward which a well-run organization typically aspires.

A hard look at soft assets

A fascinating discussion arose recently on an SIKM discussion thread to the effect, “Is knowledge an enterprise asset?” We start with the everyday meaning of an asset as “a useful or valuable thing, person, or quality.” Then there’s the technical accounting/legal meaning, starting with the general agreement that “An asset is a present right of an entity to an economic benefit.” From there we should distinguish between hard assets — tangible items that have economic value — and soft assets — intangible items that may have economic and/or non-economic value.

Traditional enterprise accounting (as codified by GAAP in the US and IFRS in Europe) for the most part describes hard assets — things that incur a monetary cost to acquire or produce. This includes property, plants, equipment, raw materials, inventory — as well as financial assets like marketable securities and cash. These are the assets that have provided most of the power of our economy’s value engine — until the mid-20th century, when intangible assets began rapidly gaining in impact.

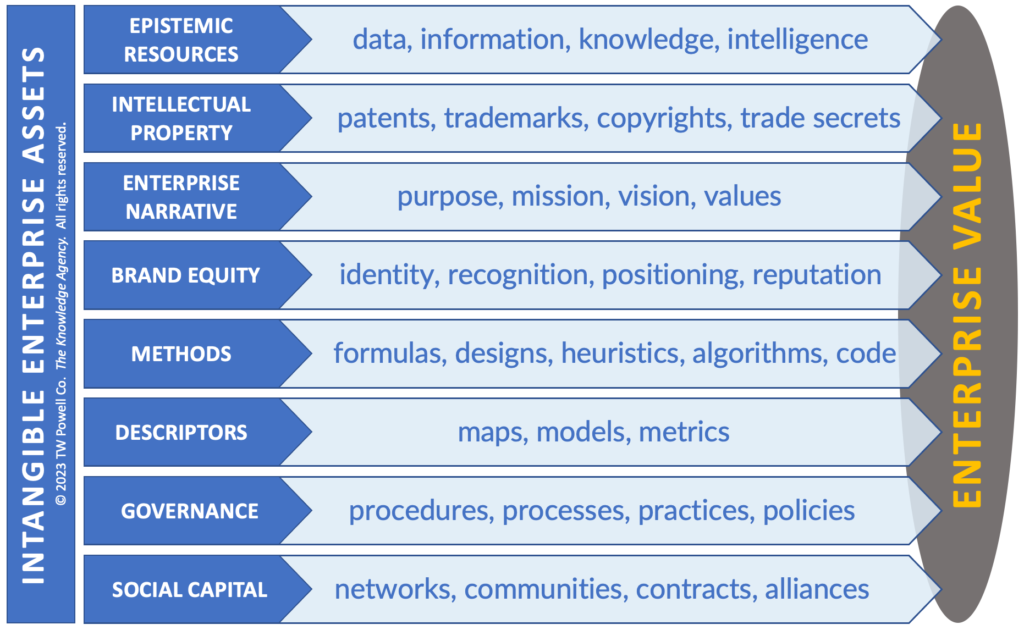

In the 21st century, we are well into the “age of knowledge” — and the ways in which we thrive and compete are increasingly intangible, virtual, and epistemic. Today, what matters competitively, more than hard assets, are soft assets such as:

In some industries, such intangibles now account for as much as 90% of total enterprise value. Yet they do not, in most circumstances, appear in formal financial statements. (The major exception being when they are purchased from an independent third party.) The true enterprise wealth of such an organization remains “dark” and unmeasurable — and thereby subject to speculation, distortion of incentives, and outright manipulation.

What does this mean for knowledge professionals?

Financial statements are produced primarily so that stakeholders will understand, in a reliable and comparable way, the economics of the enterprise in which they’re investing or otherwise conducting business. But — given that they measure only a small fraction of the assets that largely drive enterprise results today — are they still adequate to serve that praiseworthy purpose?

Hardly. And this omission fosters systemic ignorance, albeit unintentional, among the people who run organizations. Regrettably, this is not widely recognized as an urgent problem by enterprise leaders — largely because everyone works under the same “generally-accepted” principles, however limited in scope those may be. (Thanks to Prof, Baruch Lev of Stern/NYU, from whom I first learned this and who has discussed it widely.)

The problem becomes more apparent when people within enterprises — knowledge professionals, for example — attempt to measure our own contributions to the enterprise value proposition — something I continually urge us to do. By any hard metric, though, even our best work typically does not move the “traditional” value needle much — nor even appear on the map of enterprise assets.

What can we do?

In order to remain at all relevant for decision making, our formal definitions of value must evolve to include metrics for knowledge and other intangible assets. When that finally happens, we’ll be able to rigorously delineate the impact of knowledge on our economic health. Our nearly-century-old accounting systems do adapt to changing conditions — albeit at a glacial pace.

In the meantime, we must continue — and even accelerate — our efforts to manage knowledge in a credible and effective way. How can we bridge this contradiction? Here are some ideas to get you started:

- make knowledge manifest, as tangible as possible — start by mapping the knowledge resources in your organization and how they work

- link knowledge directly to concrete enterprise value levers — KPIs, strategies, and goals

- create “off balance sheet” accounts for knowledge — I have developed, for example, a Knowledge Balance Sheet (KBS) to accomplish this

My book The Value of Knowledge describes the KBS and other related frameworks. Other approaches have been described by Karl Sveiby and Tom Stewart,

My thanks to the contributors to the recent SIKM discussion that got me thinking about this.

Maybe we need a balance sheet for each intangible asset. KPIs specified and weighted by their contribution to value.